Yesterday evening fund industry association launched heavy new regulations "private investment fund raising behavior management approach", and in the private circle in the storm, small partners to find the fund Jun chat quite a lot, the new regulations after the implementation of the details of all To slowly, but fortunately the association set aside a 3-month adaptation period, and the return system is now encouraged.

Asked the fund Jun's private small partners have a lot of attention to the private circle more than two years of fund Jun is awake yesterday, thinking to learn the new rules, to do some simple and popular understanding, to the small partners for reference. Although the fund Jun limited capacity, but also want to do something, today spent a little effort to study the new rules, and produced a new regulation of private hands-on manual, hoping to help you.

After research and finishing, the fund that can be summed up as "2 to raise the main", "3 responsible party", "9-step practical operation process", 2,3,9, this memory will be relatively simple, With illustrations to explain the specific circumstances.

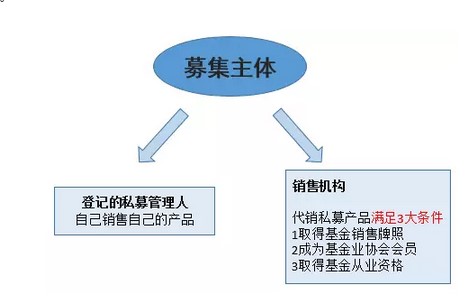

2 to raise the main body

"Raising behavior management approach" provides that after the sale of private equity products, only the private selling their own products, there is a private sales organization to sell products, but requires sales organizations have a fund sales license, is to sell public offering license, according to Commission 2 There are 124 commercial banks, 99 securities companies, 16 futures companies, 4 insurance companies, 4 insurance brokers and insurance brokers, 6 securities investment advisory bodies, 93 independent fund sales organizations, Specific can point to open the SFC "information disclosure" access.

But in fact, the fund sales license is not good to take, because the threshold is relatively high, both the capital requirements, there are facilities requirements, as well as sales staff quality requirements for some small institutions, some hardware facilities more difficult, large institutions License, through to the SFC application, field inspection and other steps, relatively easy to do down, so the future will be strong private sales strong Hengqiang situation will appear. There are interested to apply for a small partner to see over the license, some specific requirements.

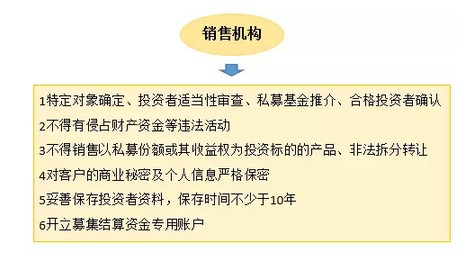

3 big raise party responsibility

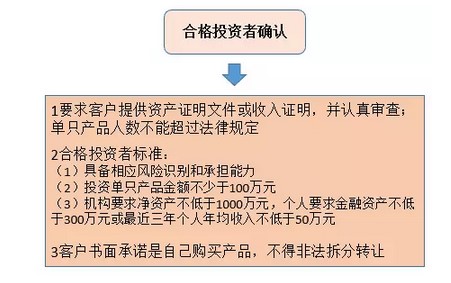

"Raising behavior management approach" provides that the private placement agencies have a lot of responsibility, including the specific object identified, the investor suitability review, private fund referrals, qualified investors to confirm; and more important is to prevent illegal fund-raising, encroachment on customers Property phenomenon, so to set up a special fund account, and let the supervisory bodies to supervise; the other before the stir-fried spin-off of private equity products sales were also banned.

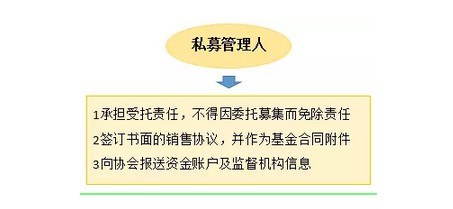

In addition to sales agencies, private managers can not be entrusted to someone else to sell their own on an easy; private equity and their sales organizations to pay attention to, and to sign a "sales agreement" Oh; also remember to submit funds to the Association account And the supervisory bodies, take the initiative to assume responsibility.

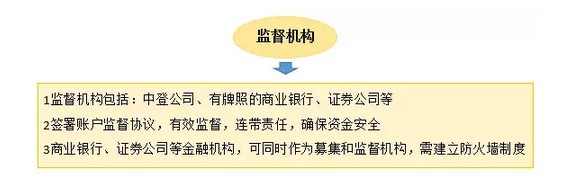

Another main body is also worth noting, is the supervisory bodies, these institutions are generally more authoritative departments, such as the board, commercial banks, brokers, etc., these institutions signed the supervision agreement capital account, it is necessary to help monitor the funds out, Funds can be returned in accordance with the original road, otherwise there are joint and several liability. As well as their own can actually be a dual identity, both as a collection agency can also serve as a supervisory authority, but in this case to establish a firewall to avoid problems.

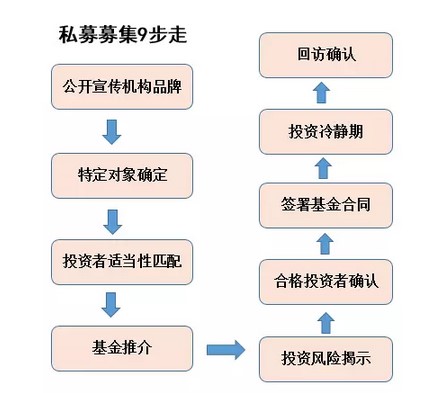

9 steps actual operation process

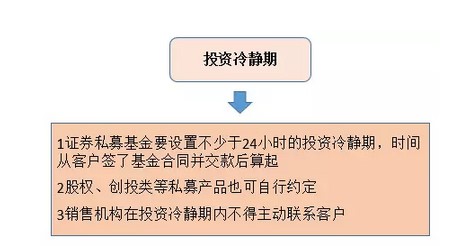

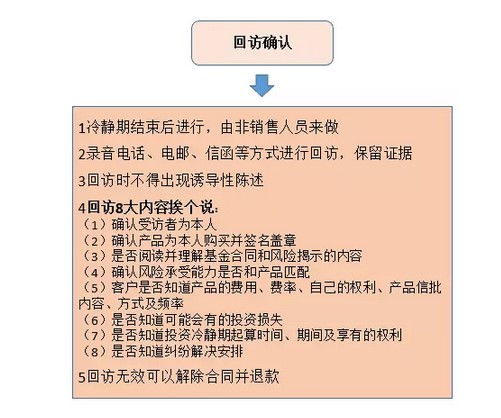

Funds Jun first on a complete process of raising the flow chart, easy to understand the process of small partners in the process, including nine steps, one publicity publicity agency brand, the second is to determine the specific object, the third is appropriate investors to match, Four is the fund to promote, five is the investment risk disclosure, six qualified investors to confirm, seven signed the fund contract, eight investment cooling-off period, nine is a return visit to confirm.

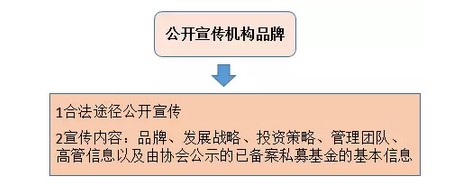

Step 1: Publicize the agency brand

"Measures to raise behavior," provides that although private offerings can not be publicized products and performance, but private companies can actually do their own brand and image of the shape, in the community to establish a good corporate image and culture, which is very good Of things, but pay attention to the publicity of the channels and scope, methods.

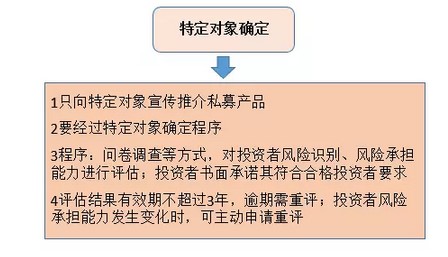

Step 2: Determine the specific object

插图:8

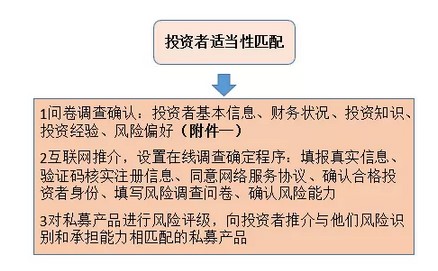

Step 3: Investor suitability matching

What is the appropriate investors, that is, suitable products sold to the right investors, matching their risk appetite, the "Measures to raise behavior" made it clear that the form through the questionnaire to understand the specific investors Situation, the risk of private equity products will be rated, so that investors buy rest assured. In addition, the online rating has been more difficult to do, the association also provides a specific process.

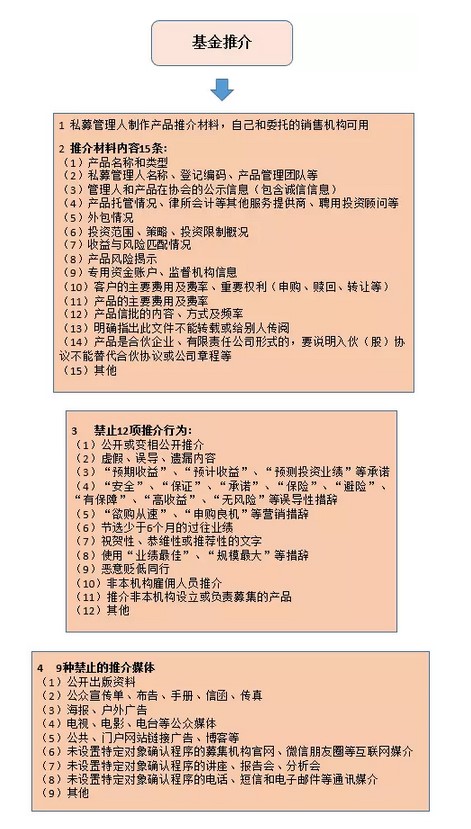

The fourth step: fund promotion

"Raising behavior management approach" The private product specific sales promotion process to do a more detailed description, because this past more problems, many marketers are very powerful, customers are easily misled. The provisions of the specific content of the promotion of 15, the fund is down to see the king to give customers a detailed, clear understanding, to avoid the customer has not figured out the specific circumstances of the product was fooled, as before paying more attention to rates and other issues But also clearly revealed.

There are sales of love in the past publicity, hunger marketing, secured income, since the sale of boast 12 kinds of behavior, are now banned orders, and what high-yield, best performance so that investors boiling words, be careful. There are 9 kinds of media can not promote, including WeChat circle of friends and so on.

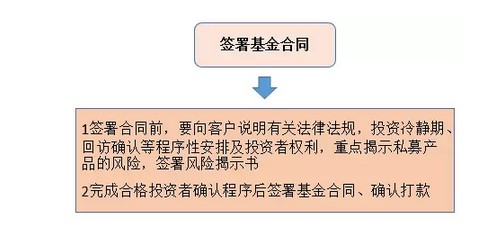

Step 7: Sign the fund contract

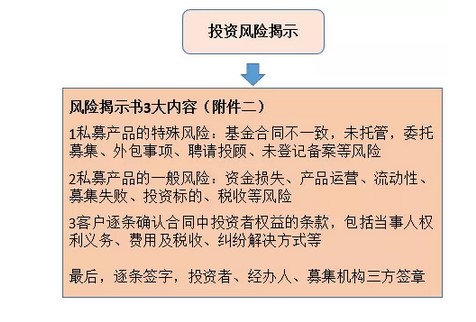

"Raising behavior management approach" provides that the signing of this step to the contract fund, the sales organization must do a good job revealing product risks, indicating the relevant laws and regulations, but also to implement the investor cooling-off period and confirm the return visit and other procedures to ensure that qualified investors , In order to finally confirm the signature, play money.

Copyright@2004-2015 All rights reserved.

Copyright@2004-2015 All rights reserved.